Maker’s MIPs process explained

Plus Aragon tussles with Autark

The Maker Protocol has been one of the most successful projects in crypto. Governance and development of the protocol has been shared by both MakerDAO, the set of smart contracts on Ethereum that MKR holders coordinate through, and the Maker Foundation, a non-profit registered in the Cayman Islands.

Since inception, Maker’s goal has been to shift governance of the protocol over entirely to MakerDAO, but the foundation has been the primary driving force for the adoption and development of Dai. MakerDAO, meanwhile, has focused on decisions around raising and lowering the stability fee or DSR.

The newly launched Maker Improvement Proposal (MIP) framework is intended to give MakerDAO the structure and capabilities promote Dai and the Maker Protocol in lieu of the foundation. Whereas some protocols are only accepting proposals with executable code, MIPs also create specific roles for humans to aid in the governance process.

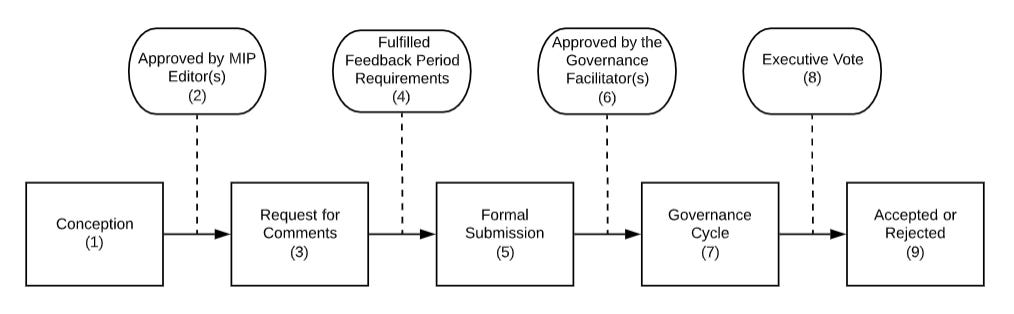

The process for a MIP:

Previously, Maker executive votes were held weekly and the contents of the executive were determined by the results of on-chain polls and polls were created from conversations on the forum or in community calls.

In a lot of ways, the MIP process is a slower-moving, more formal design of Maker’s existing governance process.

[MIP0 - MIP5] Governance framework:

MIP0: The Maker Improvement Proposals Framework lays out the framework for the whole MIP process and creates two key positions: governance facilitator and MIP editor.

MIP1: Maker Governance Paradigms lays out the scope and ambition for Maker governance. MIPs exist to address a problem space, which could vary from collateral onboarding to vote delegation to website and social media management or even the core governance framework and infrastructure.

MIP2: Launch Period simply states that the formal governance process will be paused while the initial MIPs are passed. MIP3 Governance Cycle establishes the cadence and flow of MIPs. Maker hopes to move away from its weekly cadence to a monthly cycle:

Each monthly governance cycle begins on the first Monday of the month, with Maker Improvement Proposals (MIPs) submitted by community members (defined within the MIP0 Framework). These proposals will be considered for inclusion at the end of the month's Executive vote. The governance cycle ends with an Executive vote that begins on the 4th Monday of the month.

The month cycle starts when a MIP is formally submitted, but there is a thorough review process before it can be included in the monthly governance cycle. The governance cycle is meant to gather community input early as to avoid executive votes with many MIPs. During the second week, inclusion polls are conducted to determine what MIPs should be included in the Governance poll, which is a week later and is a simple yes/no poll with any executable code. If approved, then the MIPs are put up for a full executive vote:

MIP4: MIP Amendment and Removal Process defines how passed MIPs may be modified without having to go through the entire MIPs process again. MIP5: Emergency Voting System gives the governance facilitator the ability to move quickly and address any emergencies (like Black Thursday)

[MIP6 - MIP8] Collateral onboarding:

MIP6: Collateral Onboarding Form/Forum Template provides a standardized structure for how new collateral types are added. There’s already several applications that have been submitted.

MIP7: Onboarding and Offboarding Domain teams is how MakerDAO will select and fund the workforce needed to evaluate new collateral onboarding. This includes an oracle team, smart contracts team, risk team and legal team.

MIP8: Domain Greenlight defines how these teams should report their findings to the Maker community for a decision, while MIP9: Community Greenlight defines how the community decides to approve new collateral.

Risk management

MIP10: Oracle Management is a rather lengthy MIP that details how oracles are onboarded or offboarded from the Maker protocol. Maker’s oracles may be their most unappreciated asset, but this may change as oracle innovation continues.

MIP11: Collateral Onboarding General Risk Model Management defines the overall risk management system for the protocol, as opposed to collateral specific risks.

MIP12: Collateral and Risk Parameter Management is how the Maker community can submit and contribute proposals to the risk management of the system, such as debt ceiling adjustments, oracle management and collateralization ratio.

Whew. Maker governance and the MIP cycle is certainly comprehensive and flexible in the long-term. The process fits in with the feedback and review process for other protocol upgrades, but Maker governance has a larger scope, trying to manage the Maker protocol and the Dai ecosystem. Security is paramount for a protocol upgrade and the MIPs process reflects that.

Still, Maker is an ecosystem of investors, merchants and liquidity providers. The Maker Foundation acted as a trusted intermediary for these parties. Can MIPs and the Maker governance structure replace the business development and partnership role that the Maker Foundation played?

On the Maker docket:

[Executive Vote] Change the Stability Fee Structure and Raise the USDC Stability Fee – would raise the USDC stability fee to 0.75% and change stability fee structure to allow for a negative base rate. It would create a universal base rate for all collateral and then separate adjustments for each collateral type. Discussed heavily in the forums.

On the Maker call & forums

Maker SourceCred trial – SourceCred is a “tool for communities to measure and reward value”. On the call, the team presented a system for rewarding Maker community members that are active in the forums. Users would get paid Dai for posts that contribute to governance and Maker ecosystem. They would start with $5000 Dai and work from there. An interesting idea to reward the debate and discussion that happens in forums. SourceCred ensures the system is sybil resistant and difficult to game. Perhaps most interestingly, though, this would be first instance of Dai payments from Maker.

MIP13: Declarations of Intent – a way of communicating the intent of Maker Governance to a wider audience. This MIP will lay the structure for bounty problems and potentially liquidity incentives.

With the impending approval of TUSD as collateral, there was an Interesting discussion on the call about how to manage multiple stablecoins. Some hoped to instill a stablecoin-wide debt ceiling to minimize the risk to the protocol, while others noted that there are different risk profiles for each stablecoin (custodial, credit, liquidity).

Another great presentation by Vishesh on the state of the peg.

Aragon and Autark trade barbs

Spicy times in DAO land. Over the last few months, Aragon has been in a disagreement with Autark, which Aragon funded to build apps on top of Aragon. The relationship turned sour and the original contract has not been fulfilled. Aragon hasn’t paid Autark and Aragon claims that Autark did not complete the work it was paid for (Autark denies this).

The two sides were negotiating on the remaining $800k to be paid out on the contract, but things got turned up to 11 when Aragon decided to sue Autark in Swiss Court over the disagreement.

Autark’s response to the suit:

In January 2020, the Aragon Association, for no reason, stopped payments and tried to terminate the AGP-73 grant which was an agreed-contract, voted on and approved by the community, and supposed to last through August 2020. At the moment, Autark’s November 2019 and February 2020 disbursements from AGP-73 remain unpaid, in addition to ANT incentives that were to vest as part of AGP-19.

It was not the Aragon community that tried to terminate the AGP-73 grant, but Luis and Jorge themselves, who are the board of directors of the Aragon Association (the entity bestowed with the Aragon community’s funds to represent the community’s vision).

As a result, Autark has been involved, through our lawyers, since January 2020, in good faith settlement negotiations with the Aragon Association. Except last week, without notice to Autark and in the middle of negotiations, the Aragon Association filed a baseless legal action in Switzerland against Autark LLC, a US company

After multiple threats from the Autark team to sue the Aragon Association, the Association carefully reviewed their work and involvement in the community and decided to initiate litigation to finally resolve the dispute after months of stalled negotiations.

As it was mentioned before, out of their thirteen deliverables, they only fully delivered one.

Apart from that, other reasons that lay beneath Autark’s breach of agreement are:

Interpersonal issues (including threats)

Underperformance

Lack of code quality

Breach of confidentiality (including defamation)

Not a good look for anyone and will surely cause fissures in the Aragon ecosystem, but perhaps a decentralized court would be an appropriate way to resolve the situation?

Compound

Docket: Reduce Sai collateral factor to 55%. Another step in the Sai deprecation process, its collateral factor was lowered to 65% last week.

Forums

Borrowing against WBTC - forum discussion kicked off by Sowmay at InstaDapp. Compound has accepted WBTC deposits but has not allowed them to be used as collateral, but the community is revisiting it after Maker made the move to add WBTC and its liquidity has skyrocketed. A lively discussion with several members of the DeFi community.

Changing the USDC fee structure - another post from Sowmay at InstaDapp because USDC “has more supply & less utilization than DAI but borrow rates are ~3 times higher than DAI.’

Synethix

Docket

[Implemented] SIP 55: Synth Circuit Breaker (Phase One)

[Implemented] SCCP 22: Reduce Rewards On Curve

[Proposed] SIP 60: New Escrow Contract & Migration

[Work in Progress] SIP #: Ratio Synths presumably, this is Synthetix’s response to UMA’s BTCETH token

Forums

Nice nugget from Kain, “Trading incentives incoming don't worry. And will come from sDAO not inflation so you will get your wish.”

Other Governing Things

That’s it! Feedback definitely appreciated. Just hit reply. Written in Brooklyn.

Govern This is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.